Design as an enabling tool

Posted on December 6, 2016

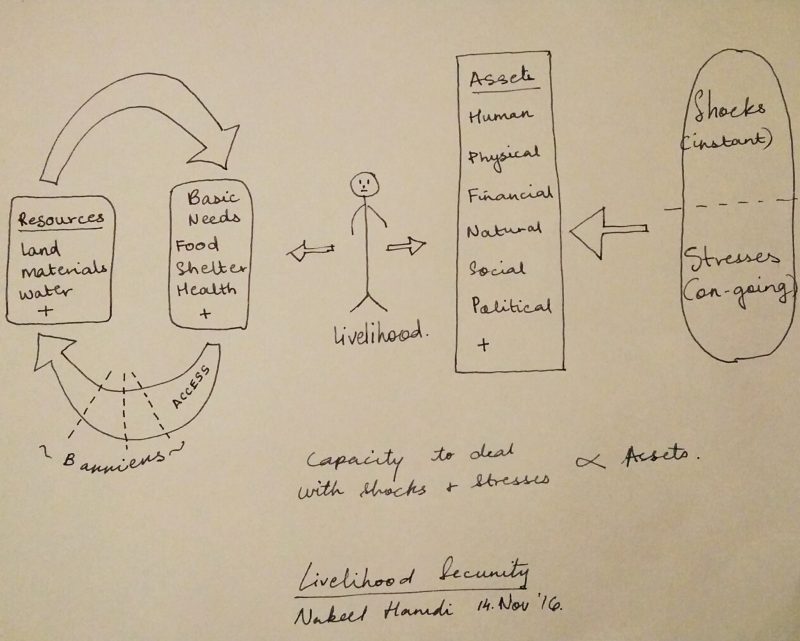

Picture credit : Sketch by Sneha Malani,

https://www.facebook.com/photo.php?fbid=10154015068012724&set=a.10150441052652724.365725.587562723&type=3&theater

On November 8th 2016, the Indian government in an unprecedented move, demonetized 500 and 1000 Rupee notes, (equivalent to $7.35 and $14.70) devaluing 86% of its currency. Bills of these denominations that haven’t been documented would be stated as invalid and rejected by the back for exchange or deposit. The intention was to curb black money (undocumented transactions, that are usually dealt in high value notes), counterfeit currency and to stop funding towards terrorism.1 Meanwhile the market is at a low, informal economy is stagnated from the monetary shock, banks and ATMs are experiencing a work overload as long ques are formed to exchange the devalued notes, but a sense of optimism prevails even as life is derailed for everyone who conducts transactions in cash – which is about 90% of all transactions.2

When considering the statistics, the move elicits criticism as a survey done in 2012 mentions that only 4.88% of cash was seized in raids by authorities from those that were hoarding black money, implying that the rest was invested in assets such as gold or land.3 It also functions less as a long-term strategy in battling corruption and more as a rash and drastic measure with little long-term impact. This diminishes the effect that was supposed to be had on black money and brings to light the imbalanced equation of benefits to losses – the brunt faced by daily wagers, farmers, shop keepers, domestic help and other jobs in the economy that don’t have formal transactions.

“The economy works best when it works for everyone. That means lowering the barriers to participation. It means creating platforms for distributed capitalism, not just a redistributed capitalism”.4

On the note of inclusiveness and participation, I would like to focus on one demography of the population that was amongst the most effected by the demonetization and most underplayed in its consequences – women workers of the low-income bracket. In India’s informal economy occupations, such as domestic help, daily wage labour, vegetable vendors and farmers, where transactions are undocumented, women workers sustain their households and save in cash for their livelihoods and their children. In some cases, owing to domestic violence, this saving is often secreted from men for bargaining capacity or safety net for victims or abuse.5

“This black money-white money is a conversation for men,” she laughed. “For us, money is food for the children.”6

As the government promises the reimbursement of losses and claims to have made a strategic step towards cashless economy, it fails to realise the unpreparedness of the country in this direction as 80% of women in India have no bank accounts7 (which makes them inaccessible to any compensation), often owing to the absence of required documents, illiteracy, cultural norm, and intimidation from and distrust in financial institutions like the bank. Even though the institutional infrastructure to address this issue is in place such as accessibility to banks and bank aid programs, this move highlights not only a misinformed understanding of the system but also the failure to create enabling conditions that address it. Instead these women are now either to lose their savings or grapple with a challenging, in some cases even impossible, task of opening an account. In essence, the demonetisation can be said to have performed as a skewed logic in an inadequate design.

This brings me to wonder how the gap between an idealised governmental policy and ground reality can be bridged. One such precedence can be found in Muhammad Yunus’s initiative of the Grammeen Bank for the poor in Bangladesh, that aimed at empowering women through micro crediting. The initiative could do so by a) building relationships of trust by learning the local area of operations, b) breaking the chain of abuse and exploitation by empowering women by assigning collateral in their names thus making them credible for the family’s financial and economic standing, c) creating a system of self-selected lending group in which participants rank their fellow group members according to financial strength and use this ranking to determine the order in which members receive their loans, with the neediest members receiving loans first.8

Grammeen Bank to me, encapsulates what can be achieved when a policy arises out of a deep understanding of existing cultural, economic, and social norms and the sensibility of how to find the pivotal place in between them to intervene for impact. It creates enabling conditions that encourages a community to participate rather than deploying tools such as ultimatums or pressures. To me this embodies a design process that is wholesome and nurturing of positive change, one that the government of India could have adapted before making an already vulnerable but integral group from the demography, victims of corollary damage of an abrasive scheme.

– Tanvi Dhond

- The Wire Staff, Pieces of Paper: Demonetisation of Rs 500 and Rs 1000 Notes Explained – The Wire. 11th November 2016, accessed on 4th of December 2016.

http://thewire.in/78694/paper-money-ban-rs-500-rs-1000-notes-explained/

- Mckinsey and Company, Mckinsey on Payments, pp 3. March 2013, accessed on 4th of December 2016

Hrishikesh Joshi, Interview with President, Operations and Technology, MasterCard, Business Standard, 8th of October 2016, accessed on 4th of December 2016

- Ministry of Finance, Department of Revenue, Central Board of Direct Taxes, New Delhi, Black Money, White Paper, pp 47. May 2012, accessed on 4th of December 2016

http://finmin.nic.in/reports/whitepaper_backmoney2012.pdf

- Don Tapscott and Alex Tapscott, Blockchain Revolution – How the Technology behind Bitcoin is changing Money, Business and the World, Penguin Random House LCC, New York, pp 48

- Samira Bose, “Owning Property Empowers Women In Unique Ways”: An Interview With Bina Agarwal, Caravan Magazine, 17th January 2016, accessed on 5th December 2016

http://www.caravanmagazine.in/vantage/bina-agarwal

- Nishita Jha, Note demonetisation: What of the women who hide cash to feed their children or to escape abuse?, Scroll, November 12th 2016, accessed on 5th December 2016

- TNN, “In India, 80% of women don’t have bank accounts: UNDP report”, The Times of India, December 15th 2015, accessed on 5th December 2016

- Evaristus Mainsah, Schuyler R. Heuer, Aprajita Kalra, Qiulin Zhang, Grameen Bank: Taking Capitalism to the Poor, Columbia Business School, pp 4, Spring 2004, accessed on 5th December 2016

https://www0.gsb.columbia.edu/mygsb/faculty/research/pubfiles/848/Grameen_Bank_v04.pdf